Planning for Retirement

Supporting Caregivers’ quality of life.

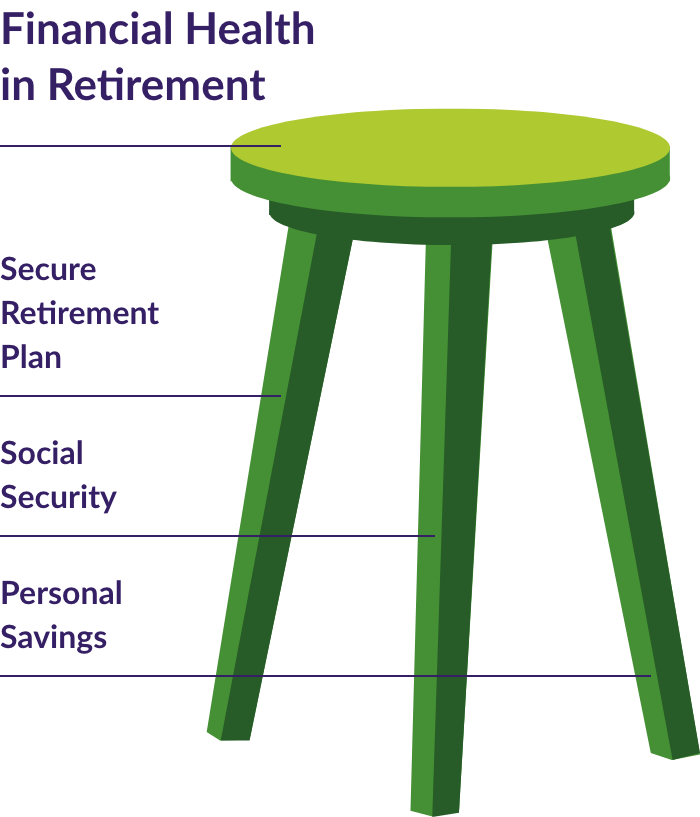

Your Secure Retirement Plan is just one source of income when you retire. It’s important to have more income sources, to make sure you can retire comfortably.

Jump to:

Common Sources of Retirement Income

Think of it as a 3-legged stool – you will need 3 sources of retirement income, to stay balanced.

Your Secure Retirement Plan (SRP)

is a benefit you get through SEIU 775 Benefits Group. Your employer adds money to your SRP account for every hour you work as a caregiver. Nothing comes out of your paycheck!

Social Security

is another common source of retirement money, but not everyone gets it. You can see if you are paying into Social Security by looking at your pay stub. If there is money entered under “Social Security Employee Tax” then you should have Social Security. Some Parent Providers may not qualify.

Almost every American worker can get Social Security benefits in their retirement by making payroll tax contributions. If you qualify, you get monthly Social Security payments starting as early as age 62. Not everyone gets Social Security, like some Parent Providers, but you may still qualify for a spousal benefit if you are married.

3 simple tips to help you understand Social Security and plan for your retirement:

- See if you qualify. You can see if you are paying into Social Security by looking at your pay stub. If there is money entered under “Social Security Employee Tax” then you should have Social Security.* Learn more about the Social Security Retirement benefit.

- Use this easy-to-use Social Security calculator. Enter your birth date and your income to see how much you could get from Social Security and how old you will be when you can start getting your full monthly payment.

- If you are ready to retire, create a my Social Security account to apply.

*If you do not qualify for Social Security, consider opening an IRA through Washington’s Retirement Marketplace. It’s easy and affordable!

Personal Savings Like an IRA

An Individual Retirement Account (IRA) is an optional retirement account that allows you to put away money from your paycheck to increase your personal retirement savings. Opening an IRA is a great way that you can save for your future.

Opening and contributing to a personal savings account is another important part of retiring. Saving as little as $5 each month can make a big difference by the time you are ready to retire.

It can be hard to plan for emergencies and unexpected costs like veterinary bills or car problems, let alone retiring. But, if you take some steps to plan, you can avoid having those expenses become a heavy burden.

4 tips to help you get started on your personal savings and saving for emergencies:

- Create a budget. Start by comparing how much money you earn each month versus how much you spend in a typical month. Then you can decide what you can spend less on, and how much money to put into a savings account.

- Set up automatic savings with your bank. You can decide how much and how often to save. Even saving as little as $5 each month can add up over time.

- Limit credit card use. Credit cards can be helpful in emergencies, but it can be easy to overspend and you may end up paying more in interest. When you have a savings account set up for emergencies instead, it could help you save money overall.

- Compare monthly expenses. Check if you qualify for a lower car insurance rate or try switching to a less expensive phone plan. The money you save could be put directly into your savings account!

Individual Retirement Accounts (IRAs)

It’s easy and affordable to open an IRA and your money grows over time!

Getting started with an IRA is easy.

Opening an IRA is an easy way to save more money for your retirement – on top of what you get through your SEIU 775 Secure Retirement Plan. You can open an IRA yourself with as little as $5.

Washington’s Retirement Marketplace is a secure website where you can compare Washington state-verified, low-cost retirement savings plans, such as an IRA.

Saving for retirement has tax advantages.

When you contribute money to retirement accounts like an IRA, you can use pre-tax dollars, which lowers your taxable income. The money in your account can grow without being taxed until you take it out in retirement. This can save you money on taxes and help you build a more secure financial future.

You can get up to $1000 per year in tax refund credits if you qualify for the Saver’s Tax Credit. The Saver’s Tax Credit reduces your income tax bill by giving you credits for money you contribute to a retirement savings account. The credit is worth up to $1,000 or $2,000, depending on income and marital status. Visit the IRS website to see if you qualify.

Whether you do it online or in-person, it’s easy to get the credit. Spending a little time on your taxes can be a valuable use of your time. If you need professional help filing for the Saver’s Tax Credit, here are 2 free trusted resources for you:

- Free IRS Tax Preparation: Get your taxes prepared by an IRS volunteer. Help is available in your language.

- AARP Foundation Tax-Aid Program: Get free of charge, in-person or virtual tax assistance. This program is designed for tax filers over 50 years old.

ICanRetire®

Access all the great tools and resources available at ICanRetire to help you plan for retirement.

Whether retirement is a few years or a few decades away, ICanRetire can help you plan. You will get tools that talk about retirement topics in a way that is easy to understand. It has quizzes, articles and videos. And it’s free!

SEIU 775 Secure Retirement Plan

The Secure Retirement Plan (SRP) provides caregivers with more income at retirement. It was created to provide another source of income in addition to your other retirement accounts.

Tips for Caregiver Money Management

Find resources for topics like tax help, retirement planning, retirement calculators, budgeting and more.

Common Retirement Terms to Know

Learn the definitions of common retirement terms and definitions you need to know in order to make decisions for your financial future.

Retirement Benefit Support

If you have questions, visit the support page or call a Milliman Secure Retirement representative at 1-800-726-8303. Help is available in your language.